What Wholesale Cannabis Pricing Is Telling Us About the Market Right Now

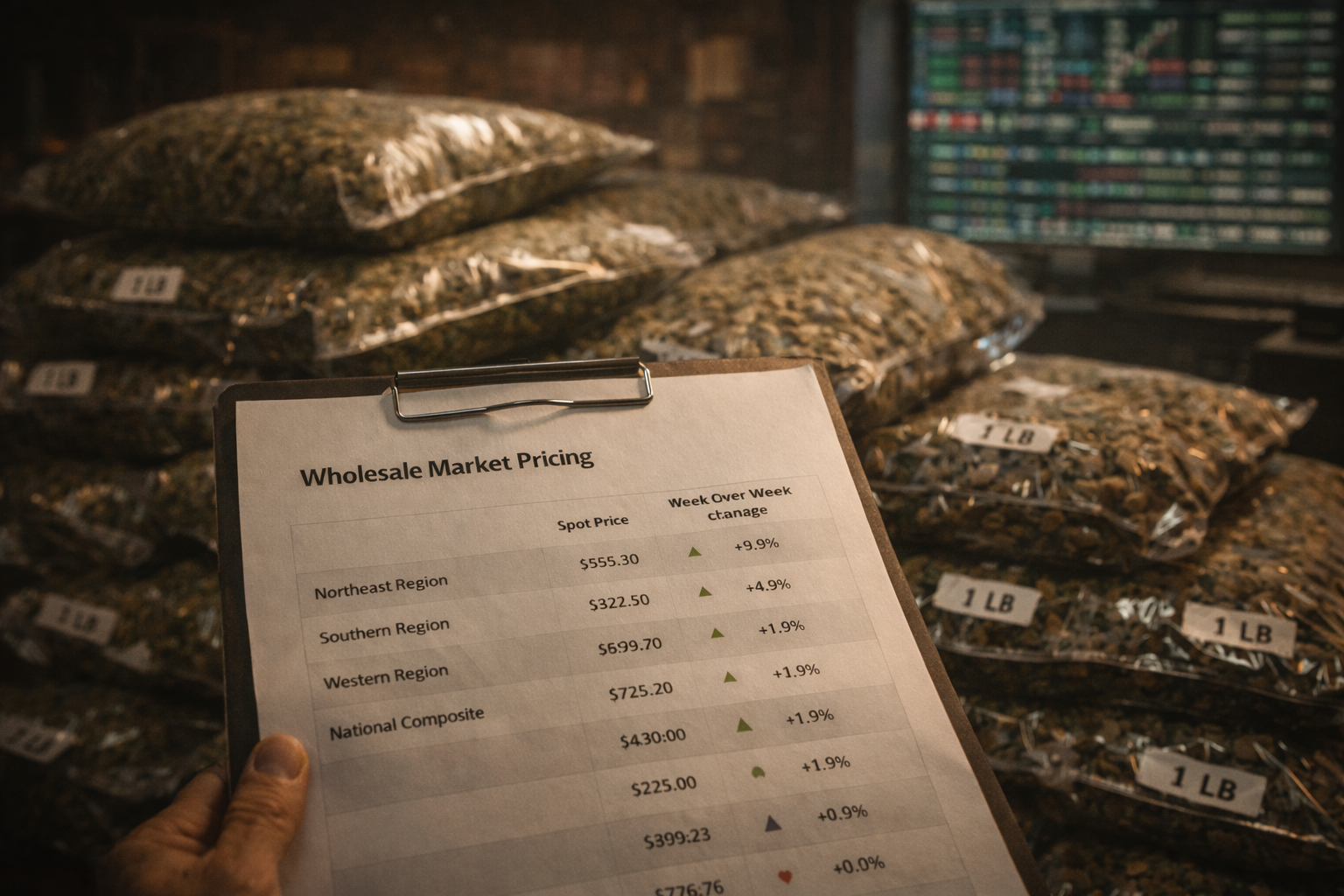

Wholesale cannabis flower packaged in bulk beside a pricing report showing regional spot prices and weekly market movement.

Wholesale cannabis pricing continues to offer some of the clearest signals about where the industry is heading. Recent spot index data and week over week movement reveal important insights into margin pressure, supply levels, and contracting behavior across U.S. cannabis markets.

For operators, investors, and service providers, wholesale pricing is not just a number. It is a real time indicator of stress, efficiency, and opportunity. Understanding these signals can help businesses make smarter decisions around production, inventory, expansion, and risk management.

If your business is feeling margin pressure or supply volatility, now is a good time to review your exposure and operational strategy. Start with our quick Cannashield intake form to prepare for shifting market conditions.

Why the Spot Index Matters

The wholesale spot index tracks the average price of cannabis flower sold in bulk across key regions. Unlike retail pricing, which can lag behind reality, wholesale prices react quickly to changes in supply and demand.

When the spot index moves week over week, it tells a story about what is happening behind the scenes.

A declining index often signals oversupply, slower retail demand, or aggressive price competition. A rising index can suggest tightening supply, improved demand, or production pullbacks.

Right now, the data points to continued pressure in many regions, with prices remaining compressed compared to prior years.

If wholesale price movement is impacting your revenue or contract strategy, Complete our Cannashield questionnaire to review how market shifts affect your risk profile.

Margin Pressure Is Still the Defining Theme

One of the clearest takeaways from recent wholesale data is that margin pressure remains widespread. Cultivators and processors are operating in an environment where input costs remain high while output prices stay compressed.

Key factors contributing to margin pressure include:

• Oversupply in mature markets

• Increased competition among licensed producers

• Retail price sensitivity from consumers

• Higher compliance and operating costs

• Limited access to capital

This combination forces businesses to operate leaner, renegotiate contracts, and focus on efficiency rather than expansion.

For many operators, the goal is no longer growth at any cost. It is survival with discipline.

Supply Dynamics Are Shifting, Slowly

Wholesale pricing also reflects changes in supply behavior. As prices stay low, some cultivators are reducing canopy size, delaying harvests, or exiting the market altogether. These decisions eventually affect supply, but the impact takes time to show up in pricing data.

In some regions, week over week pricing stability suggests that supply is beginning to balance out. In others, continued declines indicate that excess inventory is still working through the system.

These patterns are not uniform across states. Local regulations, license counts, and market maturity all play a role.

Understanding regional dynamics is critical for operators managing multi state footprints.

Contracting Behavior Is Becoming More Cautious

Another insight from wholesale data is how buyers and sellers are structuring deals. Long term contracts are becoming more selective, and spot transactions are often favored over locked pricing.

This cautious contracting behavior reflects uncertainty. Buyers want flexibility. Sellers want volume. The result is shorter commitments and more frequent renegotiation.

For businesses, this means:

• Less predictable revenue

• Greater exposure to price swings

• Increased importance of cash flow planning

• Higher risk tied to inventory timing

Operators who track pricing closely can time sales more strategically and avoid being forced into unfavorable deals.

If contract volatility is creating financial risk, Fill out our Cannashield intake form to review insurance and risk strategies that protect your operation.

What Wholesale Pricing Means for Different Operators

Wholesale pricing affects each segment of the industry differently.

Cultivators face direct pressure on revenue and must focus on yield optimization and cost control.

Manufacturers feel the impact through input pricing and product margin compression.

Retailers may benefit from lower wholesale prices, but only if consumer demand remains strong.

Ancillary businesses, including logistics and testing, feel indirect pressure as operators tighten budgets.

Across the board, pricing signals encourage efficiency, not expansion.

Why This Data Is Useful Beyond Pricing

Wholesale price reports do more than show numbers. They provide insight into the health of the industry.

Persistent low prices suggest that weaker operators may exit, leading to consolidation. Stabilizing prices may signal that markets are finding equilibrium.

For insurers, lenders, and service providers, this data informs risk assessment. For operators, it guides strategic planning.

Ignoring wholesale signals is a mistake. They are one of the most honest indicators of market reality.

Preparing for What Comes Next

Markets move in cycles. Periods of compression are often followed by stabilization, but only for those who survive the downturn.

Smart preparation includes:

• Monitoring regional pricing trends

• Adjusting production and inventory plans

• Strengthening compliance and documentation

• Reviewing insurance coverage for business interruption

• Building cash reserves where possible

These steps help businesses remain flexible as conditions evolve.

Conclusion

Wholesale cannabis pricing continues to send clear signals about margin pressure, supply dynamics, and contracting behavior across U.S. markets. While conditions remain challenging, the data also provides valuable guidance for operators willing to adapt.

Understanding and responding to these signals is essential for long term viability. Businesses that focus on efficiency, risk management, and informed decision making will be better positioned when markets stabilize.

At Cannashield, we help cannabis businesses navigate volatile conditions with insurance solutions, compliance guidance, and risk strategies built for real world market cycles.

Complete our full intake form here to protect your business and stay ahead as federal cannabis policy continues to move forward.